Overview

Paying Taxes 2019 a joint annual publication by the World Bank Group and PwC looks at tax regimes in 190 economies and provides an unrivalled global database. This year marks the thirteenth year of the publication. The report is based on the Paying Taxes indicator and includes analysis and commentary by the World Bank and PwC. Paying Taxes has historically measured the Total Tax and Contribution Rate (the cost of all taxes borne, as a % of commercial profit), the time needed to comply with the major taxes (profit taxes, labour taxes and mandatory contributions, and consumption taxes), and the number of tax payments. For the past two years, the study also includes the post-filing index that measures the process of claiming a Value-Added Tax refund and correcting a corporate income tax return. These two processes are based on four components—time to comply with a VAT refund (hours), time to obtain a VAT refund (weeks), time to comply with a corporate income tax correction (hours) and time to complete a corporate income tax correction (weeks). The overall Paying Taxes score is based on the scores of the four components.

The global average results for the case study company are almost unchanged compared to last year, yet 113 economies recorded tax reforms. The most popular reform round the world continue to be the introduction or enhancement of existing online systems for tax declarations and tax payments. The report finds that the time to comply declined in the past year by 2 hours to 237 hours; while the number of payments remained the same (24 payments). The global average post-filing index score increased very slightly, from 59.4 to 59.6 in 2017. The global average of the Total Tax and Contribution Rate remained at 40.4%.

Main Findings

- On average in 2017, it takes the case study company 237 hours to comply with its taxes, it makes 24 payments and has an average Total Tax and Contribution Rate of 40.4%. It scores 59.6 points on the post-filing index.

- The global average results for the case study company are almost unchanged compared to last year, yet 113 economies recorded tax reforms. The time needed to comply have decreased by 2 hours compared to last year while the number of tax payments remained the same.

- In 2017, the profit tax component of TTCR fell in 58 economies and increased in 37, while labour tax component of TTCR increased in 39 economies and decreased in 17.

- In 2017, 31 reforms that made it easier or less costly to pay taxes were implemented. The most popular reform continues to be the introduction or enhancement of online systems for filing and paying taxes. Mauritius made the greatest advances in tax payment systems in 2017/2018.

- Since 2004, the average time to comply has fallen by 84 hours and the average number of payments by 10.3 – both driven by technology.

- Electronic filing and payment, improved tax and accounting software and pre-populated returns are amongst the key drivers.

- The global average post-filing index score increased very slightly, from 59.4 to 59.6 in 2017.

- For those economies where a VAT refund is available, it takes the case study company 19.6 hours to comply with a VAT refund claim and 29.0 weeks to obtain the refund. The average time to comply with the CIT correction is 15.1 hours and the global average time to complete a CIT correction is 26.1 weeks.

- For those 79 economies where there would be a review of the corporate income tax return in more than 25% of cases, the review lasts on average 27.6 weeks.

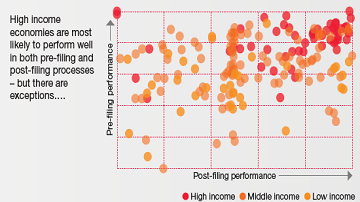

- High-income economies are most likely to perform well in both pre-filing and post-filing processes – but there are exceptions.

- Data collected this year as part of Paying Taxes suggests that training initiatives are beneficial to both the tax authorities and the taxpayers. Training for tax officers and taxpayer education can be provided through a variety of channels: seminars, online learning programmes, call centres and pilot tests.

- A full 97% of economies offer training to tax officers, but only 35% of economies provide training regularly. The most common way for taxpayers to receive information from tax authorities is via tax rulings. The second-most popular means is via call centres.